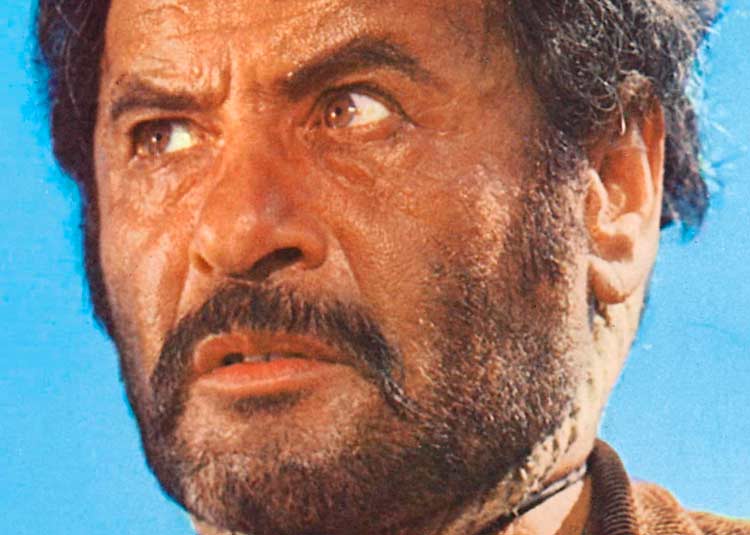

Entering the final quarter of 2022, the cannabis industry faces several challenges. Originally delivered as a brief address to the Women in Cannabis Expo held in Las Vegas in October, 2022, this post will briefly review and discuss the good, the bad and the ugly aspects of the industry. Following the order of character introduction of the classic 1966 western of the same name starring Clint Eastwood as the Good, Lee Van Cleef as the Bad and Eli Wallach as the Ugly, we’ll start with The Ugly. The article, intended to provide some insights and ideas about how to survive and thrive in cannabis 2022, will be broken up into three parts.

And for those who don’t like hearing the gloomy, doomy message of the Ugly and the Bad sections, please stick around for Part Three: The Good and remember that (spoiler alert) Clint rode away with the gold at the end of the movie.

PART ONE: The Ugly

In the movie, Eli Wallach is introduced first. His character is wild, reckless, angry, resentful, opportunistic, and, even though there are moments of cleverness and times when even the ugly blind squirrel finds a nut, in general, he is the one that seems destined to die or lose everything. For this analysis of the cannabis industry in late 2022, we’ll also start with the “ugly”, where those are the aspects that are difficult to control, definitely not pretty, and may seem overall foreboding.

Headset Analysis Points to Legacy Market Slowdown

At the beginning of Q4, Headset, a point of sale data driven analytics software company, released a report on the industry entitled, “Understanding the recent sales declines in legacy cannabis markets”. The article sought to explain away recent declines in sales in so-called “legacy” markets, where “legacy” = “mature”. You can review the report for yourself, but the overall message is not great. The conclusion offers that in the “emerging” markets (read: “new, just opened” markets), that there is still plenty of growth.

If you’re operating in multiple markets and have operations in an emerging market, then maybe that conclusion gives you some knowing relief. But if you operate solely in the “legacy” markets, the charts are just, well, ugly. Comparing results across three years of data, the market looks strong, then flat, then dead or dying. No matter which angle you follow in the article or look at on the included charts, the arrows almost exclusively point down.

Redlined New Cannabis Ventures Income Tracker

If you head over to New Cannabis Ventures and their Public Cannabis Company Revenue & Income Tracker, you’ll find a similar story. With the exception of some of the biggest companies at the top of the list who show strong operating income and a few other cannabis companies in the list who also have positive operating income numbers, albeit significantly smaller, you’ll see that a majority of them have negative operating income numbers.

Clouding the smoky picture a bit further, several of the companies on the list that show positive numbers are not cultivators, processors or retailers. They are property management, grow supply companies and pure brand plays. Once again, it’s an ugly message: very few of the actual cannabis operators are making any money at all and most of them are actually losing significant amounts of money every quarter.

As for the bigger public companies that are operating cultivation, processing and/or retail facilities? They’re making money so they must be doing good, right? Not necessarily. Although the New Cannabis Ventures analysis doesn’t really track it, the fact is that many of these companies preserve their growth by timing their acquisitions. When they start to run thin on revenue or operating income, they go buy another company and use that new influx of revenue and income to bolster their numbers so they stay on their investor and analyst “good” lists. It’s called the “acquisition growth model” and, for the most part, it works very well. But it also hides the negative income ugliness that those without deep pockets endure daily. And if those larger companies ever stop or miss the timing on an acquisition, then they will show a negative quarter and their share price will get punished.

Negative or Ugly Media Coverage

The ugly side of the industry also extends to the mainstream media. Within the past few months a feature article in the New York Times discussed the emerging problem of teen use of high THC products. The message of the story is that in an industry where the level of THC tends to dictate the market’s perception of product quality and value, the people who are not actually supposed to be using the products are. And they are moving toward the higher THC products quickly, and ending up in the hospital as a result.

In August, the industry happily welcomed the confident, knowing smile of Cookies founder and CEO, Berner, on the cover of Forbes. While cover model recognition for a previously taboo industry should have been wholly auspicious, the underlying message of the article was just plain ugly. Overregulation and overtaxation, it reported, was killing the legal industry.

Beneath photos of smiling industry players, the captions were almost all negative. Massive grows that are able to move the market and put legacy growers out of business. Bushels of product pushed through chippers and destroyed because its cheaper to destroy the product than try to sell it at a loss. Small business owners who are happy to be in the industry, but admit that legalization is actually killing their businesses.

The hidden message in the article was actually the most telling: Berner’s Cookies is successful by owning nothing but the name and the demand they built atop it — on the efforts of others who actually do the growing and selling. The ugly message here is that if you actually own a cultivation or produce manufactured goods or own a store, you’re doing it wrong. The pure brand play wins.

In Part Two of this series, we’ll talk about how, just like in the movie, the Ugly gives rise to or exposes the vexing reality of the Bad.

To find out more on this topic, or to learn more about Navvee’s services, click here.