Business Escrow Services

Secure Your Nevada Business Acquisition with Expert Escrow Services

Local Legal Expertise + Ironclad Transaction Protection

Trusted Legal Escrow Expertise for Business Transactions

With decades of experience handling complex business acquisitions, our firm provides secure, attorney-managed escrow services crafted for the unique needs of Nevada businesses and clients.

Every transaction receives meticulous legal oversight and only the highest standards for confidentiality and compliance.

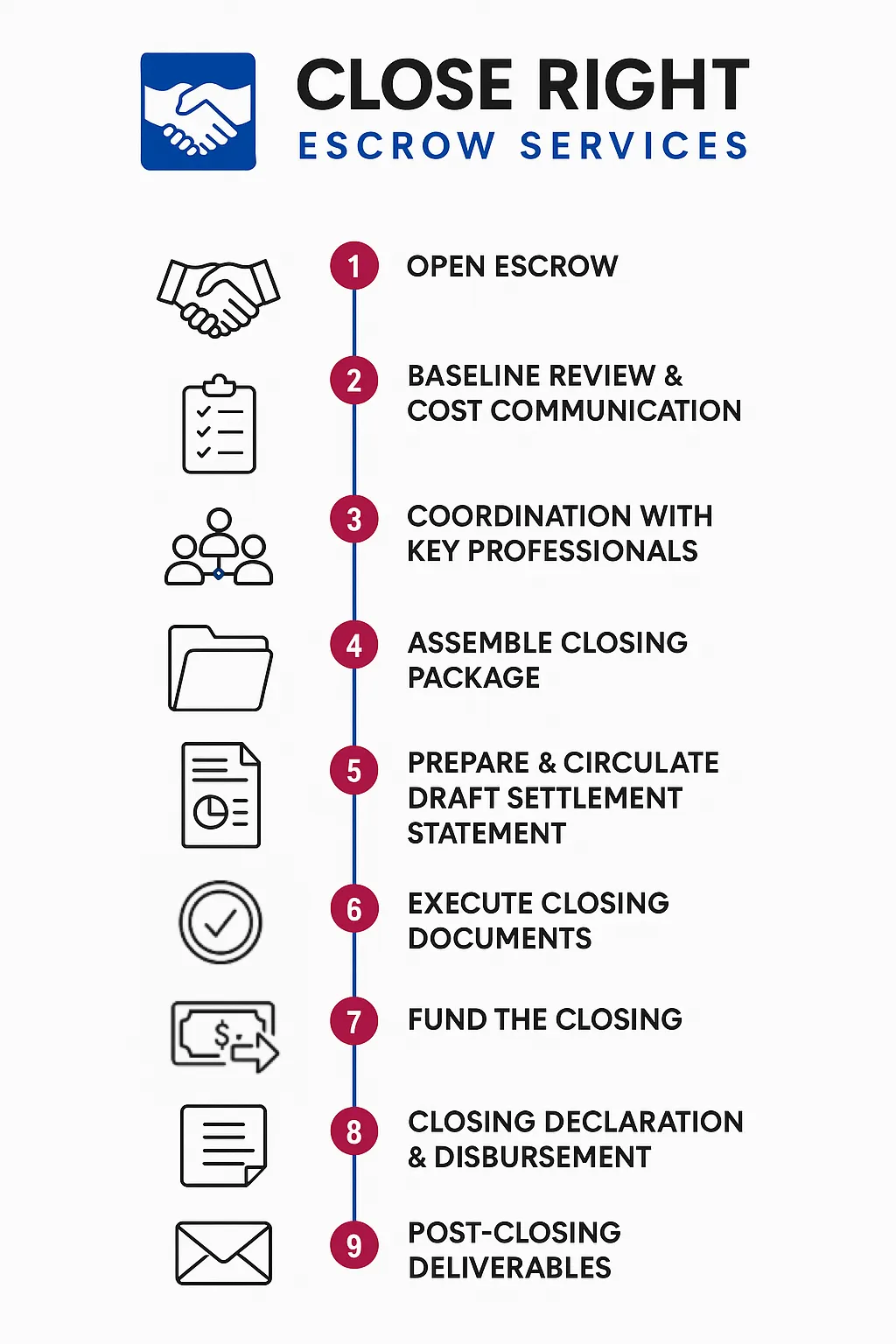

1 - Open Escrow

Trigger: Signed Purchase Agreement + Escrow Agreement + Deposits Received

> Buyer deposits Earnest Money and Escrow Opening Deposit

> Seller deposits share of Escrow Fees

> Escrow Agent confirms cleared funds in IOLTA trust account

> Agreement becomes effective and escrow is officially opened

🕓 Timing: Upon execution and cleared funds

2 - Baseline Review and Costs

> Escrow Agent reviews the deal documents and closing requirements

> Identifies missing information or additional services

> Communicates estimated third-party costs (UCC searches, certificates, etc.)

🕓 Timing: Promptly after openingNavvee Law - Close Right Escrow…

3 - Professional Coordination

> Communicates with Buyer’s and Seller’s attorneys, accountants, brokers, and bankers

> Verifies all fees and commissions

> Ensures payoffs and allocations are accurate

🕓 Timing: Ongoing through closing

4 - Assemble Closing Package

> Collects and organizes all final documents

> Includes Purchase Agreement, escrow agreement, certificates, and draft settlement statement

> Circulates for review and confirmation

🕓 Timing: At least 5 business days before closing

5 - Draft Settlement Statement

> Summarizes deposits, credits, fees, and disbursements

> Buyer confirms required wire amount to close

> Seller confirms deductions from proceeds

🕓 Timing: No later than 5 days before closing

6 - Execute Closing Documents

> Parties sign via DocuSign or in-person session

> Notarization (if required) handled in person

🕓 Timing: On (or may be before) Closing Date

7 - Fund the Closing

> Buyer (or their bank or financier) wires final purchase funds per settlement statement

> Seller’s escrow costs deducted from proceeds

> Escrow Agent confirms cleared funds before declaring closed

🕓 Timing: On Closing Date, prior to closing declaration

8 - Closing Declaration & Disbursement

> Escrow Agent confirms all signatures and funds

> Finalizes Settlement Statement

> Declares transaction closed and dates documents

> Disburses funds per settlement statement to Seller, brokers, lien holders, etc.

🕓 Timing: On Closing Date, after funds and all required documents have been verified and final Settlement Statement is prepared.

9 - Post-Closing Deliverables

> Prepares and files agreed upon state filings including UCC financing statements

> Distributes final Closing Packet:

o All executed documents

o Final settlement statement

o Confirmation of disbursements and filings

> Originals or digital copies sent via secure delivery

🕓 Timing: Immediately following closing

Tailored Escrow Solutions

Each transaction brings its own challenges and requirements. From standard business sales to multi-layered acquisitions, Close Right Escrow Services can provide the right level of support to fit your deal. Our capabilities go well beyond holding funds—we handle document preparation, verification, coordination, and specialized compliance work, seamlessly integrating these services into your business transaction escrow process when and where you need them.

Due Diligence Coordination

Comprehensive management of business verification tasks—asset reviews, UCC searches, lien checks, and tax standing confirmations—so nothing slips through the cracks before closing.

Deal Documentation

Preparation and assembly of critical transaction documents including purchase agreements, bills of sale, and related exhibits for a complete and compliant closing package.

Lien Release & Preparation

Request, obtain, and file UCC-3 and other lien releases to ensure a clear title and clean transfer of business assets. Prepare and file UCC-1 financing statements for seller security interests.

Business License Verification

Confirm good standing of the entities involved and verify all required business licenses are active and compliant at the time of closing.

Special License Review

Coordinate additional regulatory reviews or transition planning services for transfers involving liquor, health, or other specialty business licenses to prevent post-closing surprises.

Holdback & Deferred Payments

Set up and administer escrow funds for holdbacks, timed disbursements, or conditional payments based on performance or post-closing obligations.

Vehicles & Real Estate

Handle vehicle title changes and coordinate with licensed title or escrow agents when real estate is part of the transaction.

Notary Services

Provide professional notarization services for all required signatures, in-office or remotely, as part of the closing process.

Cross-Border Support

Facilitate escrow services for transactions involving foreign buyers, sellers, or currencies—ensuring compliance and secure international fund transfers.

Ready to get started?

Get In Touch and Learn More!

Ready to get the kind of assistance that will help you and your company achieve incredible results?

Then get in touch with us now, and let’s get started navigating your way to business success.

FOLLOW US

COMPANY

IMPORTANT LINKS

Copyright ©2025 Navvee - Business Advisory & Law. All Rights Reserved.